Mid-Term Crypto Giants Awakening

Greetings everyone, hope you’re all doing well. This article is going to be a classic, where I’ll lay out a perfect mid-term portfolio along with the ideal allocation size. Inshallah, you’ll see these targets hit in the coming months.

I’ll also break down the fundamental reasons behind each pick, explaining why I’m buying these tickers. But before that, let’s discuss which narrative is set to outperform the rest of the market in the upcoming cycle.

Top Crypto Narratives for 2025 & Why They’ll Boom

- AI (Artificial Intelligence Agents) – AI-powered trading, automation, and smart contracts will drive demand for AI-linked crypto projects like FET, AGIX, and RNDR. Big Tech AI advancements will fuel adoption.

- RWA (Real-World Assets) – Tokenization of bonds, real estate, and stocks will bridge TradFi & DeFi, unlocking trillions in liquidity. Institutional giants like BlackRock & JPMorgan are already investing in on-chain RWAs.

- Gaming (GTA VI & Blockchain Games) – The Web3 gaming sector is growing with Play-to-Earn (P2E), NFTs, and metaverse projects. Layer-2 scaling (Polygon, Immutable) will make blockchain gaming smoother.

- Main Ecosystem (Bitcoin, Ethereum, Solana) – Bitcoin Halving (April 2024) will reduce supply, historically triggering a bull run. ETH’s Dencun upgrade will cut gas fees, boosting DeFi. Solana’s explosive growth in dApps and GameFi makes it a strong contender.

I’m only focusing on leader altcoins because when the real rally begins, it’s the strongest alts that will drive the market forward. The targets are already set, and these coins are positioned to perform.

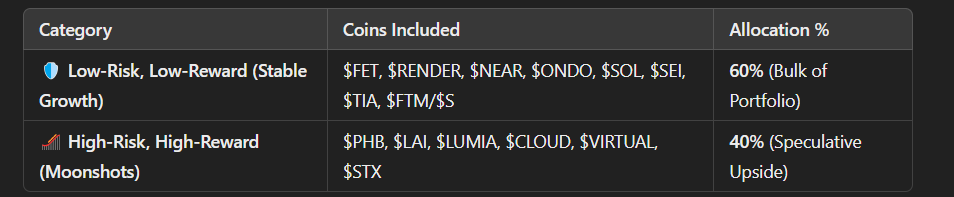

I’ve categorized them into two groups:

- Low-Risk, Low-Reward – More stable, steady growth.

- High-Risk, High-Reward – Higher volatility but bigger potential gains.

Here’s why I’m buying these coins, their use cases, and what to watch in the coming bull run: 🚀

1. $FET (Low-Risk, Low-Reward) – AI

- Use Case: Automates DeFi and data sharing with AI agents.

- Why Buy: Strong partnerships (e.g., Bosch), stable AI narrative, decent liquidity.

- 2025 Narrative: AI-driven dApps & automation will thrive—FET is well-positioned.

- Buying Levels: R1(0.9810 – 1.1111) & R2(0.7961 – 0.9248) *R = Range

2. $RENDER (Low-Risk, Low-Reward) – AI

- Use Case: Decentralized GPU rendering for metaverse, gaming, and AI.

- Why Buy: High-profile collaborations (Hollywood, Apple’s Vision Pro rumors).

- 2025 Narrative: Demand for GPU power in AI & AR/VR will explode—Render benefits.

- Buying Levels: R1(4.262 – 5.280) & R2(2.998 – 3.410)

3. $PHB (High-Risk, High-Reward) – AI

- Use Case: AI & cybersecurity platform, bridging data analytics with blockchain.

- Why Buy: Smaller market cap = higher upside if the AI hype continues.

- 2025 Narrative: Could become a go-to for secure AI solutions—if it executes well.

- Buying Levels: R1(1.1369 – 1.3178) & R2(0.9615 – 1.0100)

4. $NEAR (Low-Risk, Low-Reward) – AI & Infrastructure

- Use Case: User-friendly Layer-1 with AI integrations & dev tools (e.g., NEAR GPT).

- Why Buy: Strong dev community, continuous updates (NEAR BOS, Pagoda).

- 2025 Narrative: Likely to capture DeFi, NFT, and AI synergy if it keeps innovating.

- Buying Range: R1(3.558 – 4.400)

5. $LAI (High-Risk, High-Reward) – AI

- Use Case: Emerging AI project—focus on data, machine learning, or predictive tools.

- Why Buy: Potential to ride the next AI wave; smaller cap for bigger upside.

- 2025 Narrative: If AI + blockchain sees mass adoption, LAI could be a breakout.

- Buying Levels: R1(0.00802 – 0.00607)

6. $ONDO (Low-Risk, Low-Reward) – RWA

- Use Case: Tokenizing real-world assets (bonds, T-bills), bridging TradFi & DeFi.

- Why Buy: Institutional backing (think BlackRock narratives), stable yield potential.

- 2025 Narrative: RWA tokenization is set to unlock trillions—ONDO is early.

- Buying Levels: R1(1.49000 – 1.34024) & R2(0.95833 – 1.19726)

7. $LUMIA (High-Risk, High-Reward) – RWA

- Use Case: Another real-world asset project with a smaller market cap.

- Why Buy: If RWA becomes the next major DeFi boom, LUMIA could see explosive growth.

- 2025 Narrative: High upside if it secures big partnerships & adoption.

- Buying Levels: R1(0.796 – 0.901) & R2(0.639 – 0.761)

8. $SOL (Low-Risk, Low-Reward) – Solana

- Use Case: Ultra-fast L1, home to DeFi, NFTs, and emerging consumer dApps.

- Why Buy: Solid dev ecosystem, memecoin mania, strong performance post-FTX.

- 2025 Narrative: With super low fees and big brand integrations, Solana could dominate.

- Buying Levels: R1(175.86 – 200.59) & R2(159.86)

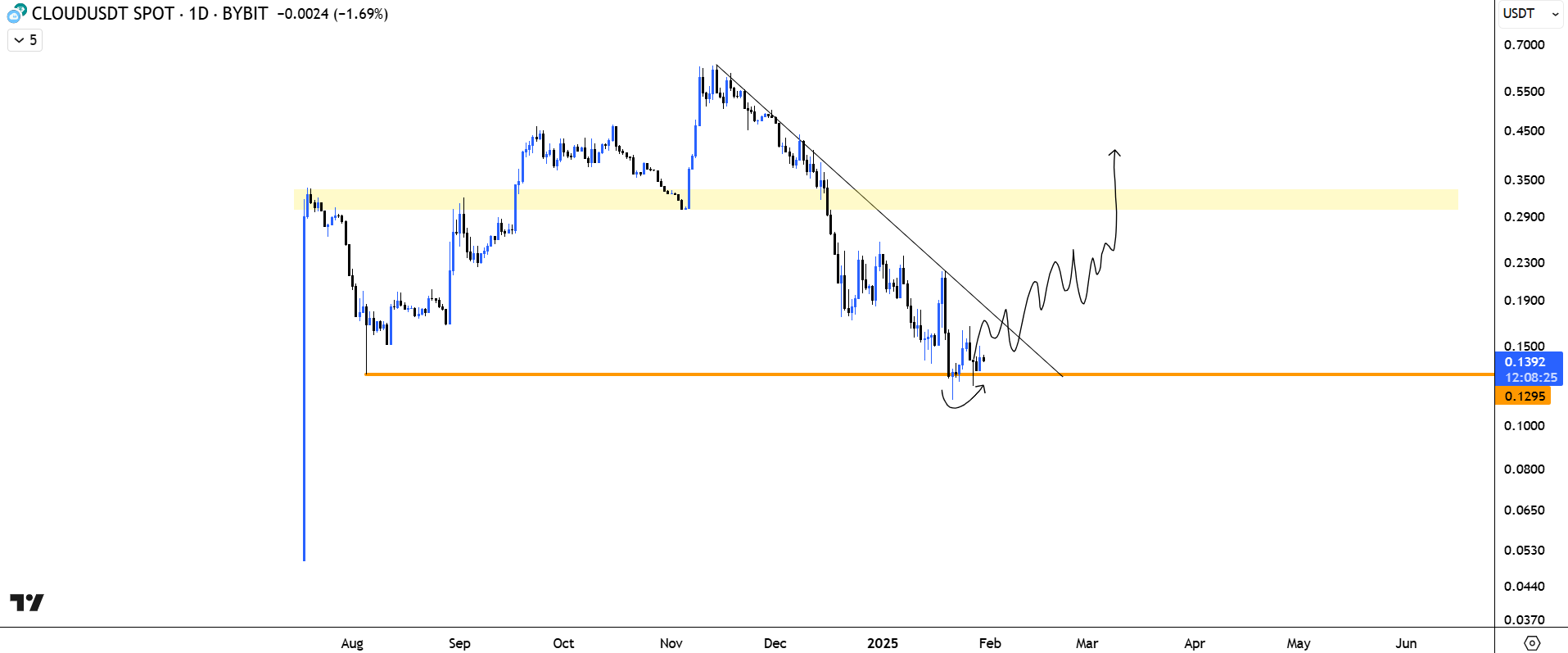

9. $CLOUD (High-Risk, High-Reward) – Solana

- Use Case: A Solana-based project, possibly focusing on data or cloud-like functions on chain.

- Why Buy: Leverages Solana’s speed & ecosystem—could see big gains if it delivers.

- 2025 Narrative: If Solana soars, smaller ecosystem tokens like CLOUD can 10x.

- Buying Levels: R1(0.1114 – 0.1295) & R2(0.0841 – 0.1089)

10. $VIRTUAL (High-Risk, High-Reward) – AI Agents

- Use Case: AI-driven metaverse or agent-based platform bridging NFT, VR, and automation.

- Why Buy: Could ride the AI + Metaverse wave, smaller cap = big upside.

- 2025 Narrative: If AI agents in virtual worlds go mainstream, $VIRTUAL could skyrocket.

- Buying Levels: R1(1.91740 – 1.73837) & (1.54605 – 1.29959)

11. $STX (High-Risk, High-Reward) – BTC Ecosystem

- Use Case: Smart contracts on Bitcoin (Layer-2), NFTs on BTC.

- Why Buy: Taps into Bitcoin’s brand while enabling DeFi/NFTs—massive potential.

- 2025 Narrative: If Bitcoin L2s thrive, STX will be front and center.

- Buying Levels: R1(0.983 – 1.140)

12. $SEI (Low-Risk, Low-Reward) – L1

- Use Case: High-performance L1 focusing on order-book style DeFi.

- Why Buy: Newer chain, but with heavy funding and strong exchange listings.

- 2025 Narrative: Could evolve into a top-tier DeFi chain if adoption follows hype.

- Buying Levels: R1(0.3071 – 0.3401) & R2(0.2529 – 0.2866)

13. $TIA (Low-Risk, Low-Reward) – L1

- Use Case: Celestia’s modular blockchain approach—separating consensus & execution.

- Why Buy: Industry buzz around modular blockchains; Celestia leads the narrative.

- 2025 Narrative: Next-gen blockchain architecture could dominate, giving TIA a strong edge.

- Buying levels: R1(3.000 – 3.880) & R2(2.368)

14. $FTM or $S (Low-Risk, Low-Reward) – L1

- Use Case: Fantom ($FTM) for scalable DeFi, or $S (possibly another recognized L1).

- Why Buy: Proven track record in DeFi, stable ecosystem, active dev community.

- 2025 Narrative: Established L1s usually ride the bull wave—steady growth.

- Buying Levels: R1(0.4246 – 0.4871) & R2(0.3118 – 0.3639)

Why These Picks?

- AI – Massive trend, fueled by Big Tech & on-chain demand.

- RWA – Institutions are eyeing trillions in tokenized assets.

- L1 Ecosystems – Scaling wars & new features drive adoption.

- BTC Ecosystem – Post-halving hype could push Bitcoin L2s to new heights.

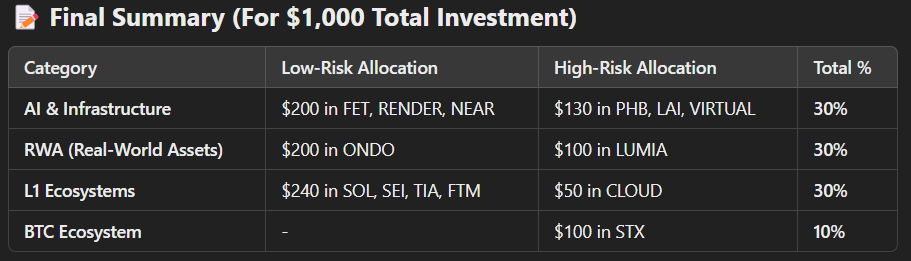

Allocation Size per Category

Breakdown by Category

DYOR & Manage Risk: High-reward coins can pump hard but carry more volatility. Low-risk coins might not 10x overnight but can anchor your portfolio in a bull run.

Hope you understand the plan. If you found this thread useful, give it a like and focus on accumulating only within the given levels.

Why This Allocation Works

✔ 60% Safe, 40% Speculative → Balances growth & risk.

✔ AI, RWAs, L1s, BTC Ecosystem → Covers all major narratives for 2025.

✔ Low-risk projects provide stability, high-risk projects offer big upside.

What’s your top pick from this list? Let’s print this bull run! Let’s discuss it more on Discord.